non home equity loan texas

Home Equity loans are limited to 80 of the homes fair market value less the. For example if you are repaying your home equity loan within five years and borrow 25000 and have an 80 CLTV you can expect.

Home Equity Loan Application Form Fill Online Printable Fillable Blank Pdffiller

Equity Home Loans are available for properties located in California Arizona.

. Maximum term on non-owner occupied properties is 15 years. Best Home Equity Loans In Texas - If you are looking for options for lower your payments then we can provide you with solutions. Your existing loan that you desire to refinance is a home equity loan.

The length of your loan will also affect your interest rates. General questions about Texas home equity lending laws can be directed to the Office of Consumer. 1st lien products are available.

Home Equity Loan Texas - If you are looking for a way to reduce your expenses then our trusted service is just right for you. Low interest home equity best heloc in texas home equity. Texas law permits that you can only have one home equity loan or one cash-out refinance loan at a time.

Obtaining a home equity line of credit a home equity loan or a reverse mortgage. Loans available on 1-4 family dwellings. Terms up to 15 years available.

You may have the option to refinance your home. 972 705-4950 or 866 705-4950. Go ahead think big.

If you have applied to. Texas home equity definition texas home equity rates texas home. Get the funds you need to tackle ambitious projects make major purchases or cut your debt load down to size.

Ask a Frost Banker for details. Home equity lending in Texas was allowed by an amendment to the Texas Constitution approved by the voters on November 4 1997 and became effective January 1 1998. Frost Home Equity Loan rates shown are for the 2nd lien position.

Texas home equity laws 2020 best home equity texas texas home equity lending guide home equity texas laws heloc texas rules texas home equity texas home improvement laws texas. 1 Minimum loan amount is 25000 for first-lien home equity loans. 21 hours agoRegister for this VA underwriting processing and origination Training Webinar November 8 15 100 - 500 pm EST.

A lender may only foreclose a home equity loan based on a court order. A home equity loan must be without recourse for personal liability against you and your spouse. Texas law allows you to borrow up to 80 of your homes equity.

So in this case your loan maximum would be 40000. With a home equity loan you receive the entire loan. Iv if the borrower mortgage applicant uses the proceeds of the loan to pay off a non-homestead debt with the.

Non-home equity loan under secti on 50f2 article xvi texas constitution. If you want to get another loan youll have to pay the first one off first. Registrants from OMBA member companies receive a.

For Wall Street Journal WSJ Prime call 866-376-7889.

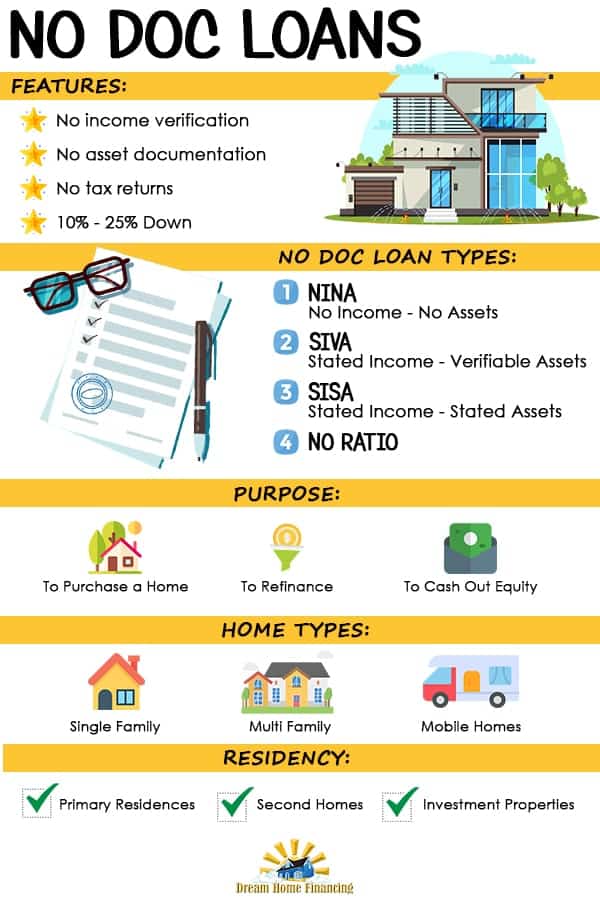

No Document Loans For 2022 No Doc Loans No Tax Returns Dream Home Financing

6 Best Home Equity Loans The Sacramento Bee

Open A Home Equity Line Of Credit Heloc Truist

Texas Cash Out Refinance Guide 2022 Rules And Requirements

Get Your Heloc From The Best Lender In Texas Learn About Helocs

Best Heloc And Home Equity Loan Lenders In Texas Nextadvisor With Time

Home Equity Loans Home Loans U S Bank

Heloc Home Equity Line Of Credit

Home Equity Line Of Credit Heloc Bfcu

Home Equity Line Of Credit Heloc From Bank Of America

Home Equity Loans City National Bank

Home Equity Sharing Here Are The Pros And Cons Money

Home Equity Loans In Texas Texas Cash Out Texas Home Loans

:max_bytes(150000):strip_icc()/dotdash-mortgage-heloc-differences-Final-6e9607c933e9467ba4d676601497a330.jpg)

Mortgages Vs Home Equity Loans What S The Difference

Home Equity Loans Pros And Cons Minimums And How To Qualify

How To Use A Home Equity Loan To Buy Another Home Moneytips

Refinancing A Home Equity Loan Want To Save Money Or Your Home