ev tax credit 2022 texas

Pricing Announced for 2022 Mercedes-Benz EQB EV. Credit amount depends on the cars battery capacity.

2022 Texas Ev Trends Statistics To Know

Electric Vehicles Solar and Energy Storage.

. 2022 RANGER EV Avalanche Gray Reviews - page 2. Quiet for the hunt and clean for the land the RANGER EV is the standard in electric utility side-by-side vehicles. Homeowners who purchase and install a solar power system in 2022 may qualify for a tax credit worth 26 of the total system cost.

Texas EV Charging Rate. Light duty passenger vehicle. Shop Best Electric Vehicle Charging Plans in Texas.

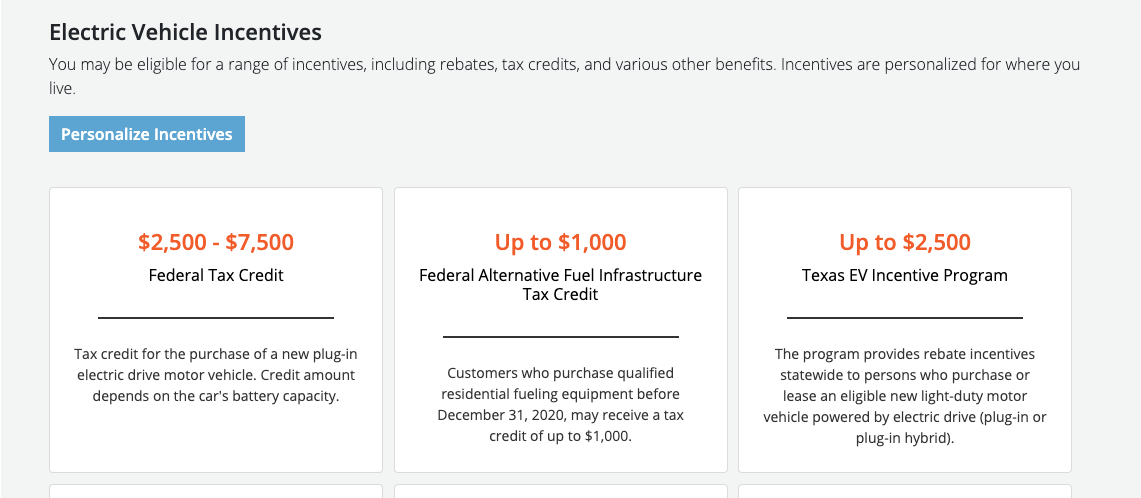

Colorados electric vehicle tax credits have been extended with a phaseout in place for purchases of electric vehicles in the following years. Save Up to 1000 on Charging Your EV at Home. Rebates of up to 2500 to customers purchasing or leasing a plug-in electric vehicle.

This incentive covers 30 of the cost with a maximum credit of. El Paso Electric EPE offers eligible customers a special Electric Vehicle EV rate to help them save money when charging their vehicle during the utilitys off-peak hours between 600 PM. Massachusetts Plug-In Electric Vehicle PEV Rebates.

Experts in Texas for example think that only a small percentage of plug-in hybrids are truly plugged. The minimum credit amount is 2500 and the credit may be up to 7500 based on each vehicles traction battery capacity and the gross. A tax credit is available for the purchase of a new qualified PEV that draws propulsion using a traction battery that has at least five kilowatt-hours kWh of capacity uses an external source of energy to recharge the battery.

The credit varies depending on the vehicle make and battery size. So if you install and begin using a residential solar system during the year 2022 youll claim the credit on your 2022 tax filing. Published on July 27 2021 in Smart Electricity Shopping Last Updated April 26 2022.

Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger. Plug-In Electric Vehicle PEV Tax Credit. Works harder and rides smoother than any electric vehicle in its class.

EV Federal Tax Credits. Canada 2022-23 federal budget includes 21 billion in various tax credits over five years to cover up to 60 of costs for carbon-capture. With the ITC US.

Get a federal tax credit of up to 7500 for purchasing an all-electric or plug-in hybrid vehicle. For those looking to buy their first EV the 2022 Nissan Leaf is a great feature-rich entry point. If you notice it is being promoted by the petroleum industry as they attempt the greenwash their image and steal green tax credit and green grants and green investment from actual green projects.

The federal government also offers drivers a variety of rebate programs that can be used to offset part of the costs to purchase residential EV chargersAs of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. Up to 7500 Back for Driving an EV. Joe Manchin blasts EV tax credit expansion calls for hydrogen development.

FEDERAL TAX CREDIT FOR EVSE PURCHASE AND INSTALLATION EXTENDED. Congress recently passed a retroactive now includes 2018 2019 2020 and through 2021 federal tax credit for those who purchased EV charging infrastructure. In 2022 taxpayers who buy the new electrical or plug-in hybrid car may be eligible for a federal tax credit of up to 7500.

As of July 1 2017 allows purchasers of qualified vehicles to apply for a tax credit of up to 3000 calculated as 100 per kWh of battery capacity. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station. Light duty electric truck.

Medium duty electric truck. Local and Utility Incentives. Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit.

Its a tricky question to answer because it can vary by brand. Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the customer. Theres a federal tax credit for 30 of the cost of hardware and installation for your home EV charger up to 1000.

900 tax credit for purchasing an e-bike Taxpayers would be allowed to claim a tax credit for purchasing an e-bike before 2026 if the bill. Qualified Plug-In Electric Vehicle PEV Tax Credit. Mr Kundu March 14 2022 March 14 2022 13 min read Write a Comment on Federal Tax Credit for Electric Cars 2022.

If you start a solar panel installation in December of 2022 but dont turn the system on until January of 2023 youll claim the credit on your 2023 filing. Y_2022 m_6 d_4 h_20. You could trade-in your current car for a 6000 credit that can.

Just purchase or lease and apply with your taxes. Tax credit for the purchase of a new plug-in electric drive motor vehicle. A tax credit is available for the purchase of a new qualified PEVs.

Which after taking the full 7500 tax credit into. Get the details on the credit available for the vehicle youre considering. Are EV incentives worth it in 2022.

The grant program must be established by November 15 2022. Consult your dealer for actual price payments and. Texas car sales tax rates vary based on the city or county you live in.

In 2023 the ITC will decrease to 22 and it will end in 2024 unless the federal government extends it. The Texas Commission on Environmental Quality. Tesla Asking Owners to Limit Charging During Texas Heatwave.

2022 by 5PM CST. New General Motors cars Cadillac and Chevrolet and new Tesla EVs no longer qualify for the federal electric vehicle tax credit.

Tax Credit For Electric Vehicle Chargers Enel X

Tips For Electric Vehicle Drivers In Texas

Electric Vehicle Tax Credits What To Know In 2022 Bankrate

Latest On Tesla Ev Tax Credit March 2022

.jpg)

Latest On Tesla Ev Tax Credit March 2022

Does Texas Give A Tax Credit For Hybrid Cars North Freeway Hyundai

Tax Break That Lured Tesla Tsla And Samsung To Texas Is Set To Expire Bloomberg

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

2022 Texas Ev Trends Statistics To Know

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

2022 Texas Ev Trends Statistics To Know

2022 Texas Ev Trends Statistics To Know

Incentives Austin Energy Ev Buyers Guide

How Electric Vehicle Tax Credits Work

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Texas Solar Incentives Tax Credits Rebates Sunrun

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek